Consumer, merchant, Ecommerce

Storytelling in a regulated FinTech adds $37M billings.

In 2016 I joined what seemed almost like a startup within a corporation. We could push to production in an instant (much like when Coldplay instantly took down our merchant checkout tools with their pre-sale event).

Problem

I was tasked with "increasing billings" and with lots of data and insights tools at my disposal, including free reign to query our SQL database, I set out to research all my hunches.

Solution

One hunch and corresponding data told me we should redesign our forms to add client side error handling instead of server side. Working with the lead engineer, this was a quick fix for a nice little reward.

Impact

We recovered $225k in missed ARR due to failed merchant setups. This was the first of many steps in increasing merchant confidence in our tools, which eventually led to us acquiring an additional 768 merchants.

Quantitative data told us that, despite extra steps in the flow being potential for friction, cardmembers spent more money and abandoned less frequently when presented with personalized steps like options to pay in installments or Pay with Points.

Problem

The business wanted to direct more Membership Rewards transactions to cheaper ways of burning Points, and this was a good opportunity to help the business to see the value of design.

Solution

I hypothesized that advertising PWP in the CM account, giving more affordance to the Pay With Points options by switching the dropdown to a freeform number entry field, and offering MR without step-up auth, would result in increased usage.

Impact

PWP saw up to a 3X increase per market after launch of our global optimizations. It saw up to 4 times more usage when step-up auth was not required. My team won the Ed Gilligan award for innovation.

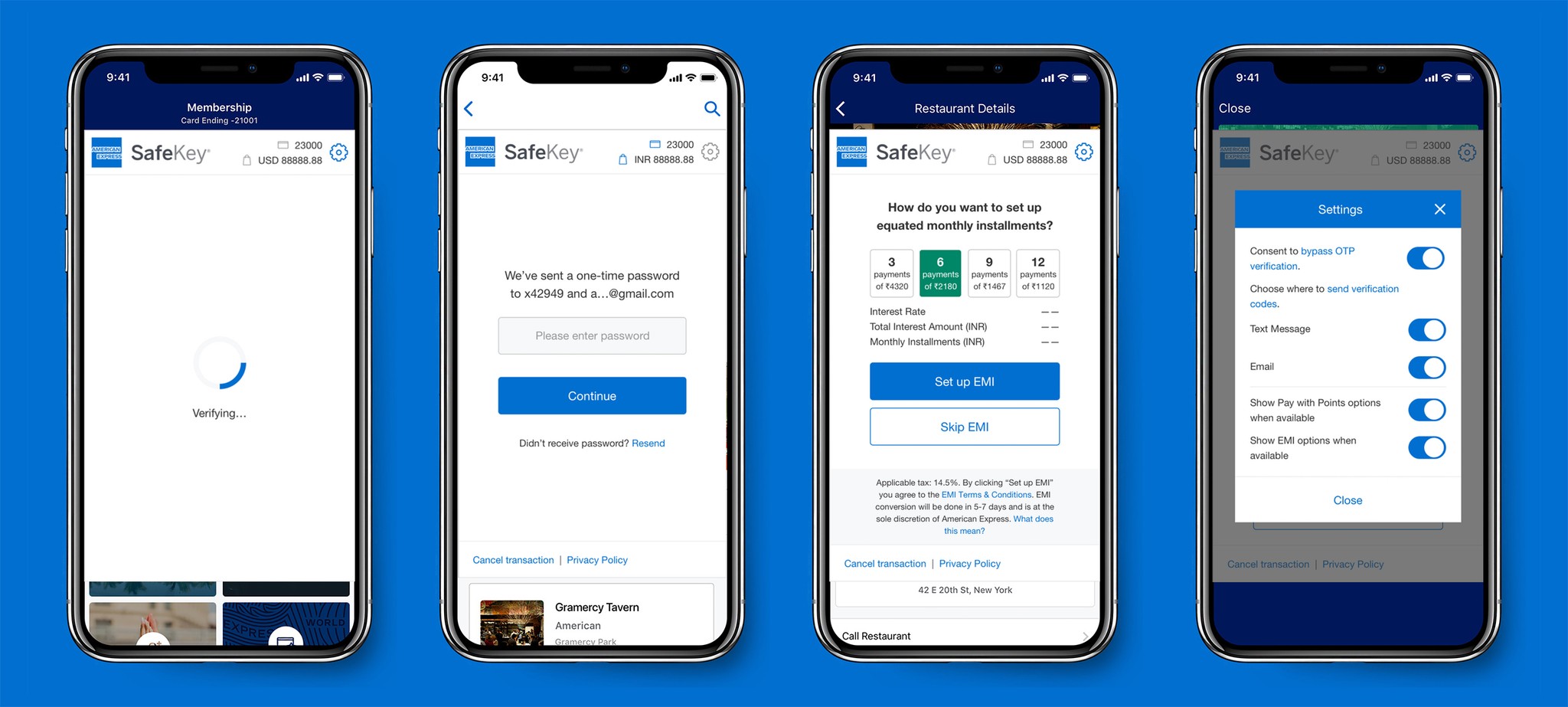

Qualitative data told us that Cardmembers abandon their purchase when they think they're being phished. A quick Google of 'SafeKey'… returned results about spam and phishing.

Problem

Transaction and device data told me that 67% of Cardmembers abandon when seeing SafeKey for the first time. The general consensus was that they didn't have their phone on them to receive the one-time code. My intuition told me it also had to do with an outdated, inauthentic design.

Solution

As well as a modern, authentic look, SafeKey needed a responsive design that paid special attention to custom iFrame sizes. I built a case for redesigning the UI and UX, which was finally getting buy-in through persistence and storytelling - and a Tweet from Airbnb about a failed purchase due to UI issues helped nudge our user stories to the top of the backlog.

Impact

SafeKey's average success rates improved by a minimum of 0.3% per market post-redesign, which equates to roughly $37M in annual billings.

After the years my design colleagues and I had spent evangelizing, the company at large was getting on the same page. I got to work closely with Pentagram implementing the DLS and Accessibility.

Problem

Despite our new seat at the table, red tape continued to slow us down.

Solution

Storytelling and relationships were still key to expediting processes and getting work prioritized, and I was keen to make Amex an early advocate for Accessibility.

Impact

With a compelling deck demonstrating my audio-based navigation using ARIA, I to was able to get Accessibility prioritized along with DLS enhancements, despite being considered low value due to less than 1% of Cardmembers using screen readers.

Design: the ones who make it pretty a trusted partner who solves problems.

Expedience and regulation were still at loggerheads. To keep online payments snappy in the wake of new regulation from Europe's PSD2, I was tasked with designing a solution.

Problem

PSD2 meant all transactions in Europe had to go through mandatory step-up authentication, regardless of AmEx's sophisticated fraud tools. This added friction was a deterrent to merchants.

Solution

I designed a concept for an Express checkout feature - allowing Cardmembers to bypass ongoing authentication for their favorite stores by authenticating once through their online account, or at the time of purchase.

Impact

We ran rapid labs with 20 Cardmembers to test our concepts and make refinements. The feedback helped us refine it, and - getting to wear my Product Manager hat too - I launched it in 18 countries, fully localized, with 50% adoption in the first 6 months.

Empathetic storytelling is what gets us over the finish line - that's lesson 1… but an uncharacteristic direct reply from Steve to Ted (a customer who correctly guessed Steve's email address) taught me something else: listen to your customers, in all the different ways they communicate.

Problem

There was a bug in our Instant Card Number journey - something we wouldn't have known if it wasn't for Ted and Steve's exchange - and I was tasked with looking into it.

Solution

After listening in to calls, looking at Fullstory captures, and testing it on different devices, I found what looked like the root cause - the button to retrieve your ICN was hidden below the fold on some devices.

Impact

I left AmEx for Silicon Valley before the fix got implemented, but AB testing showed us that 77% of CMs retrieved their ICN in my experiment vs 51% in the control.